Overall, solar companies are looking for more specific software solutions to fix a narrower set of problems.

While it may seem niche, the world of solar software is becoming larger and more diverse by the minute.

According to Paul Grana, co-founder of software firm Folsom Labs, the general trend in the solar software space is toward fragmentation.

“There are literally thousands of apps just for sales teams alone — not even HR or marketing, let alone the integration of technology,” he said in an interview last week at GTM’s Solar Software Summit in San Diego.

While managing a wide range of software solutions can add complexity, it’s also an opportunity. “Fragmentation means that a team is working on a narrower problem, and is therefore able to solve it more effectively because they can understand it better, and you get better products,” Grana said.

“The buyer who is running a business using these apps is going to…have five options to choose from and can pick the best-in-class [product] for their needs,” he added. “Within any narrow niche, there’s a big difference.”

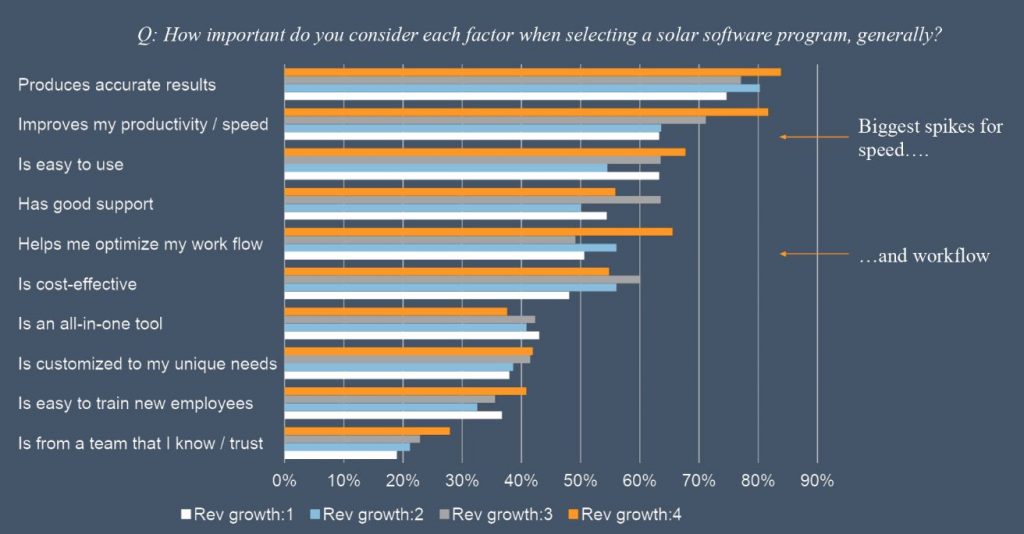

The trend toward diversification aligns with the findings of a forthcoming Folsom Labs and GTM Research survey, in which 600 solar developers, engineers and consultants identify pain points they’re looking for software to solve. Companies aren’t looking for technology solutions to that can do a dozen things at once, according to Grana. Rather, they’re looking for multiple tailored solutions that can solve specific challenges.

Based on the survey, understanding utility rates is a top priority for the solar industry. The majority of respondents (60 percent) said Excel spreadsheets are how they keep track of utility rates. Energy Toolbase was the next most popular software platform among survey takers (18 percent), followed by UtilityAPI (10 percent).

Grana noted that there are other software solutions out there to help solar companies manage utility rates. What’s likely driving the demand for a technology fix in this space is that utility rates are becoming more complicated, particularly for distributed solar.

For instance, California’s Net Metering 2.0 transition has made selling rooftop solar significantly more complex. Telling customers what their rates, and thus their solar savings are, “has gone from something a salesperson can do on a calculator at the kitchen table, to something you need to plug in to a model to figure it out,” Grana said.

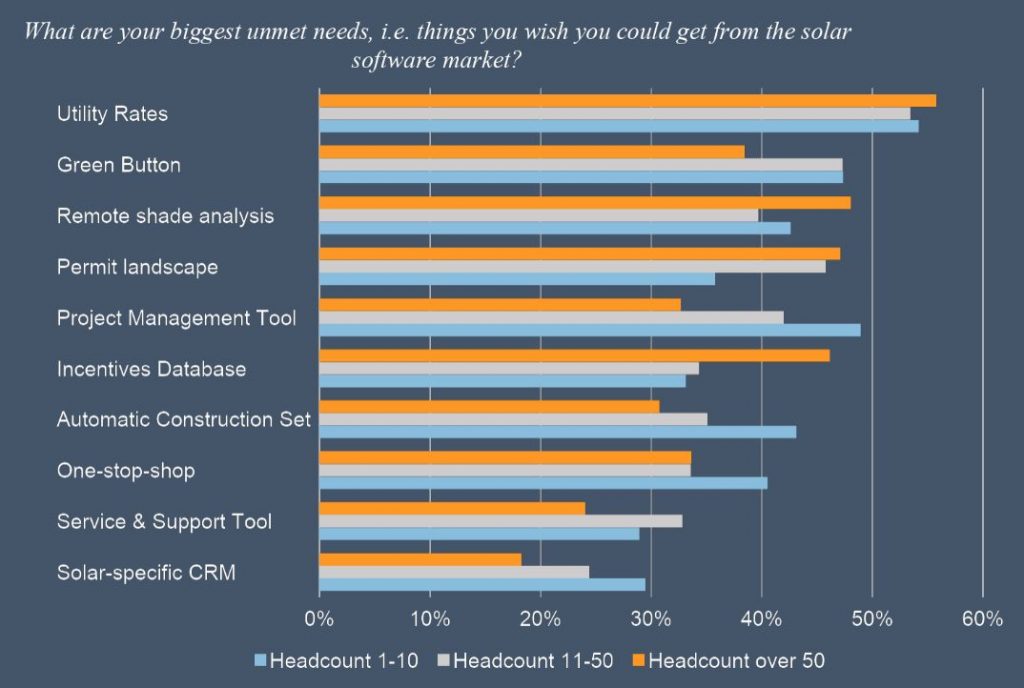

For larger companies, remote shade analysis, the permitting landscape and incentive databases are unmet needs that respondents want software to fix. For smaller companies, project management tools, remote shade analysis and support for Green Button, a standardized way to access energy usage data, emerged as priorities.